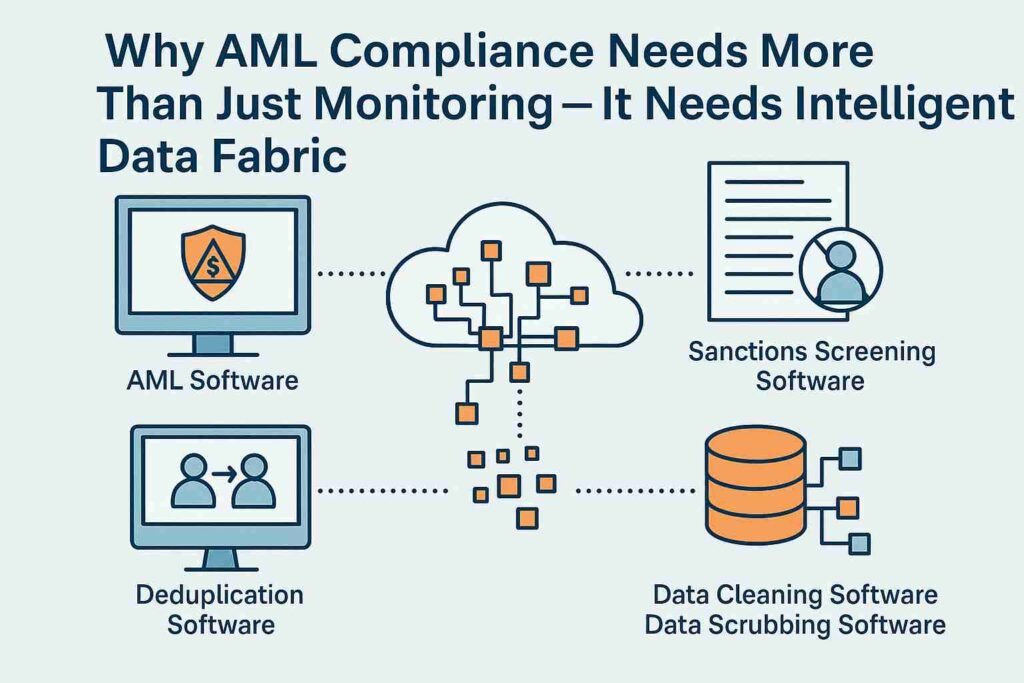

In today’s fast-paced financial world, compliance teams face an uphill battle against sophisticated financial crimes. While monitoring transactions is essential, it is no longer enough to stay ahead of money launderers, fraudsters, and sanction evaders. This is where intelligent data fabric and modern AML software step in to bridge the gap. Effective Anti-Money Laundering frameworks require advanced tools that not only monitor suspicious activity but also integrate and analyze data intelligently across multiple sources in real time.

Financial institutions are under increasing pressure from regulators, customers, and shareholders to safeguard against illicit activities. If compliance teams rely solely on monitoring tools, they risk missing hidden patterns, delayed alerts, or incomplete profiles of high-risk entities. This limitation opens the door for bad actors to bypass detection systems. Intelligent data fabric enables AML teams to connect, clean, and enrich their data so that they can detect and stop suspicious transactions before they cause harm.

One key area where intelligent data fabric shines is in integrating sanctions screening software with other compliance solutions. Screening customer names against sanctions lists is a regulatory requirement, but without intelligent integration, it can become inefficient and prone to errors. Intelligent data fabric helps centralize this process by pulling data from multiple sources, ensuring that all sanctions checks are accurate, up to date, and part of a wider risk assessment framework.

Another crucial element in improving AML compliance is deduplication software. Duplicate customer profiles or transaction records can create blind spots in monitoring systems. For example, if a customer appears in the system under two slightly different names, their risk profile may be underestimated. Deduplication ensures that every customer or transaction is represented only once, reducing false negatives and improving alert quality.

Why Monitoring Alone Falls Short

Traditional monitoring tools track transactions and flag those that seem suspicious based on predefined rules. While useful, they often generate large volumes of false positives, overwhelming compliance teams. Worse, they may fail to catch subtle patterns that unfold over time or across multiple accounts. For example, small amounts moved across different accounts might go unnoticed if systems are not designed to connect the dots.

Modern financial crime requires a broader, smarter approach. Criminal networks often exploit fragmented data systems, inconsistent recordkeeping, and outdated monitoring methods. Intelligent data fabric addresses these weaknesses by ensuring that compliance teams have access to complete, clean, and connected datasets.

The Role of Intelligent Data Fabric in AML

An intelligent data fabric acts as the connective tissue between different compliance tools, databases, and external data sources. It standardizes, cleans, and enriches data, making it more valuable for analysis. By linking disparate systems, intelligent data fabric creates a single, unified view of customers and transactions.

This approach transforms how compliance teams work. Instead of relying on separate systems for transaction monitoring, sanctions screening, and customer due diligence, teams can access all relevant data in one place. They can quickly identify patterns, investigate alerts, and make informed decisions with confidence.

Data integration also helps meet regulatory requirements more efficiently. Many AML regulations require institutions to maintain accurate and up-to-date customer information, conduct thorough risk assessments, and provide detailed audit trails. Intelligent data fabric makes these processes seamless by ensuring that all systems share the same accurate data.

Enhancing Sanctions Screening

Sanctions screening software is essential for ensuring that no business is conducted with individuals, companies, or countries under international sanctions. However, its effectiveness depends on the quality of the data it uses. If names are misspelled, incomplete, or stored in different formats, the system may fail to identify sanctioned entities.

With intelligent data fabric, sanctions screening becomes more precise. Data is standardized before being checked, reducing the risk of missed matches. The system can also handle multilingual names, alternative spellings, and complex ownership structures. This means compliance teams can detect sanctioned entities even when they attempt to hide their identity through slight variations in their personal or corporate details.

Eliminating Duplicate Records

Duplicate records are a hidden threat to AML compliance. When a customer appears multiple times in a database, each profile might hold only partial information. This fragmentation can prevent risk systems from recognizing a suspicious pattern. For example, one profile may list a customer’s legitimate transactions while another shows activity in high-risk regions. Individually, these profiles might not raise red flags, but together, they could reveal money laundering activity.

Deduplication software solves this by scanning for and merging duplicate records. It uses matching algorithms to identify when two records refer to the same person or entity, even if the information is not identical. This process not only improves monitoring accuracy but also streamlines reporting and reduces operational costs.

Data Cleaning and Scrubbing for Better Compliance

Clean data is the foundation of effective AML compliance. Without it, even the most advanced systems can produce unreliable results. That is why compliance teams often rely on data cleaning software and data scrubbing software. These tools remove errors, correct inconsistencies, and standardize formats across datasets.

For example, data cleaning can fix incomplete addresses, unify date formats, and correct misspellings. Data scrubbing takes this further by removing unnecessary or irrelevant information. Together, these processes ensure that monitoring and screening systems have the best possible data to work with. The result is fewer false positives, faster investigations, and more accurate risk assessments.

Real-World Benefits of Intelligent Data Fabric in AML

Financial institutions that adopt intelligent data fabric see a range of benefits:

-

Faster Investigations – With all relevant data connected and cleaned, investigators can quickly assess alerts and focus on genuine risks.

-

Lower Compliance Costs – By reducing false positives and automating manual tasks, institutions save time and resources.

-

Stronger Risk Detection – Integrated data allows for better pattern recognition and more accurate detection of suspicious activity.

-

Regulatory Confidence – Accurate, centralized data supports compliance reporting and reduces the risk of fines or reputational damage.

The Future of AML Compliance

The financial landscape is evolving rapidly. Criminals are using more sophisticated methods to disguise illicit transactions, and regulators are raising the bar for compliance. Simply monitoring transactions will not be enough to keep pace. Intelligent data fabric, combined with advanced AML software, provides the comprehensive approach needed to stay ahead.

In the future, we can expect to see even more automation in AML processes, powered by artificial intelligence and machine learning. These technologies will work best when fed with accurate, unified data from intelligent data fabric. Compliance teams will be able to move from reactive to proactive strategies, identifying risks before they cause harm.

Conclusion

AML compliance is not just about monitoring transactions. It is about understanding the complete picture of customer behavior, connecting disparate data sources, and ensuring that every decision is based on accurate, up-to-date information. Intelligent data fabric makes this possible by integrating systems, cleaning data, and eliminating duplicates.

By combining intelligent data fabric with sanctions screening software, deduplication software, and robust AML software, financial institutions can strengthen their defenses against financial crime. The addition of data cleaning software and data scrubbing software further ensures that the information driving these systems is reliable and precise.

The fight against money laundering and financial crime demands more than vigilance—it demands intelligence. Institutions that invest in these technologies will not only meet regulatory requirements but also protect their reputation and contribute to a safer financial system for everyone.