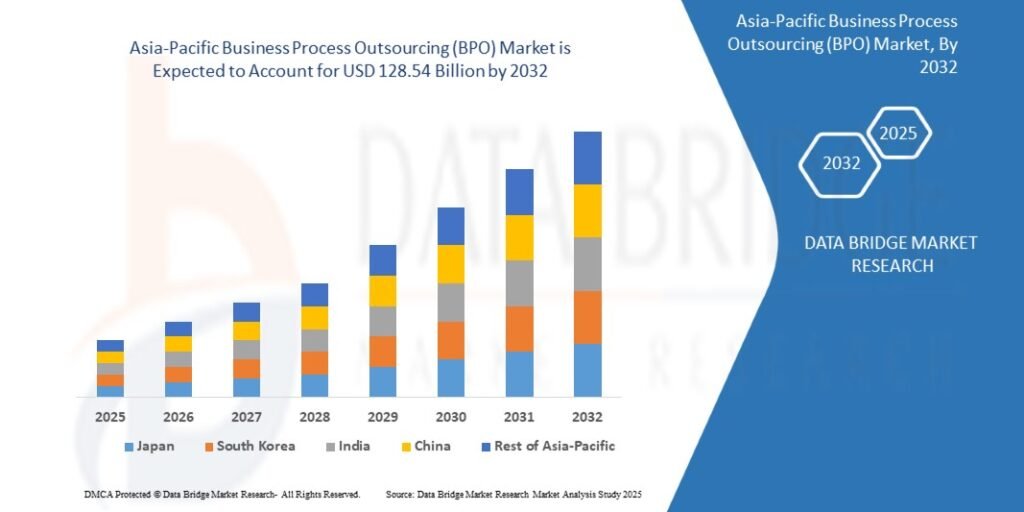

Executive Summary

The Asia-Pacific (APAC) BPO market is entering a new growth phase defined by AI-enabled operations, cloud-native delivery, and outcome-based contracting. Traditional cost arbitrage remains relevant, but buyer priorities have shifted toward resilience, multilingual coverage, regulatory compliance, and measurable business results. India and the Philippines continue to anchor voice and back-office delivery at scale, while emerging contenders—Vietnam, Malaysia, Indonesia, Sri Lanka, and Fiji—add capacity and language diversity. Mature buyer markets in Japan, Australia, Singapore, and South Korea are accelerating demand for high-compliance processes, analytics, and customer experience modernization.

Source – https://www.databridgemarketresearch.com/reports/asia-pacific-business-process-outsourcing-market

Market Overview

APAC BPO spans customer experience (CX) management, finance and accounting (F&A), human resources outsourcing (HRO), procurement, supply chain operations, health information management, banking and insurance processes, and knowledge process outsourcing (KPO) such as data engineering and risk analytics. Delivery models are increasingly hybrid: a hub-and-spoke architecture with regional command centers orchestrating in-country, nearshore, and offshore teams under unified platforms and security. Growth is supported by expanding digital economies, e-commerce scale, fintech innovation, and healthcare modernization across the region.

Key Growth Drivers

-

Digital-First Consumers and Omnichannel CX

APAC’s mobile-centric consumers demand always-on, multilingual support across chat, messaging apps, voice, and social. Enterprises are upgrading to omnichannel contact centers, journey analytics, and proactive service—fueling demand for CX BPO with deep technology integration. -

Cloud and Platformization

Rapid migration to cloud contact centers, workflow/BPM suites, and data platforms enables Business Process as a Service (BPaaS). Buyers prefer standardized, API-ready stacks that shorten time-to-value and support continuous optimization. -

AI, Automation, and Analytics

Robotic process automation, conversational AI, and agent-assist copilots are raising productivity, improving first-contact resolution, and compressing handling times. Demand is strongest where providers combine domain-trained models, governance, and human-in-the-loop oversight. -

Regulated Industry Outsourcing

Banks, insurers, telecoms, and healthcare organizations are expanding outsourced KYC/AML, claims, revenue cycle, and compliance operations. APAC hubs with strong data protection regimes and skilled talent pools capture disproportionate share. -

Talent and Language Diversity

Beyond English, demand for Japanese, Korean, Mandarin, Thai, Bahasa Indonesia/Malaysia, and Vietnamese support is rising. Secondary locations provide language adjacency and business continuity at competitive cost.

Challenges and Risks

-

Wage Inflation and Attrition: High-demand metro hubs face rising labor costs and turnover, pushing providers to invest in upskilling, career paths, and multi-city footprints.

-

Data Privacy and Cross-Border Rules: Fragmented regulations—data localization, sectoral privacy, and sovereignty concerns—necessitate robust compliance frameworks and in-region hosting.

-

Operational Resilience: Climate risks and infrastructure disruptions require multi-site designs, distributed work models, and strong business continuity planning.

-

Capability Gaps in Niche Skills: Specialized KPO (actuarial, advanced analytics, clinical coding) can be supply constrained; partnerships with universities and targeted academies are essential.

Segmentation

By Service Line

-

Customer Experience (CX): Voice, chat, messaging, social care, sales support, technical support, collections—with AI routing, quality automation, and real-time guidance.

-

F&A and Procurement: Procure-to-pay, order-to-cash, record-to-report, vendor management, and spend analytics.

-

HRO: Payroll, benefits, talent acquisition, onboarding, and employee helpdesk with self-service portals.

-

Industry-Specific BPO:

-

BFSI: KYC/AML, sanctions screening, loan processing, trade finance, disputes.

-

Telecom/Tech: Provisioning, field service scheduling, device returns, L1/L2 tech support.

-

Healthcare: Coding, billing, prior authorization, patient access, clinical data abstraction.

-

Travel/Logistics/E-commerce: Reservations, fraud prevention, order management, last-mile exceptions.

-

-

KPO and Data Services: Data engineering, MDM, model ops, marketing science, risk analytics, ESG reporting.

By Delivery Model

-

Onshore/In-country: For high-compliance workloads and language-critical CX (Japan, Korea, Australia).

-

Nearshore/Regional: Secondary APAC sites offering language and time-zone affinity (e.g., Malaysia for Mandarin/English, Vietnam for Japanese support).

-

Offshore/Global: Scale operations from India, the Philippines, and blended hubs, governed regionally.

By Buyer Size

-

Large Enterprises: Multi-tower, multi-region deals with transformation roadmaps and value-based SLAs.

-

Mid-Market and Digital Natives: Modular BPaaS with rapid deployment, transparent pricing, and prebuilt integrations.

Country Spotlights

-

India: Deepest talent pool for English back-office, finance, tech support, and analytics; strong capability in automation, data engineering, and platform operations. Tier-2/3 cities expand capacity and lower attrition.

-

Philippines: Global leader for voice CX with high cultural alignment; expanding into chat, content moderation, healthcare revenue cycle, and omnichannel hubs.

-

Malaysia: Multilingual delivery (English, Malay, Mandarin) with strong compliance; popular for banking and technology clients.

-

Vietnam: Fast-growing alternative for Japanese/Korean support, software-enabled operations, and digital content services.

-

Indonesia: Large domestic market driving in-country CX; Bahasa delivery with growing English capability for regional support.

-

Sri Lanka, Bangladesh, and Fiji: Niche nearshore options offering competitive costs, good English skills, and resilience diversification for regional portfolios.

-

Australia, Japan, South Korea, Singapore: Predominantly buyer markets with selective in-country outsourcing for regulated processes and premium CX; also serve as regional governance hubs.

Technology and Operating Model Trends

-

Omnichannel and WFM 2.0: Cloud routing, real-time forecasting, and intraday re-optimization improve service levels and agent experience.

-

Agent Assist and Quality Automation: Live summarization, knowledge retrieval, and automated QA increase consistency while preserving empathy in interactions.

-

Process Intelligence: Task mining and process mining identify automation candidates and quantify ROI; continuous improvement becomes contractual.

-

Data Security by Design: Zero-trust networks, DLP, encrypted PII, and privileged access management embedded in delivery playbooks.

-

Distributed Work: Hybrid/home models expand the talent radius and enhance continuity; secure VDI and policy-driven device controls are standard.

Commercial Models and Governance

-

Outcome-Based Pricing: Shift from FTE to KPIs like first-contact resolution, NPS/CSAT, DSO reduction, clean-claim rate, or compliance pass rates.

-

Gain-Share for Automation: Providers co-invest in bots/AI and share realized savings; dashboards ensure transparency.

-

Phased Transformation: Start with stabilize-and-standardize, then automate and re-imagine journeys; value tracked via baseline comparisons.

-

Vendor Consolidation with Best-of-Breed Pods: Fewer strategic partners overseeing curated specialists for niche tasks under common governance.

ESG and Talent

-

Inclusive Hiring and Skills Uplift: Apprenticeships, return-to-work programs, and digital academies for analytics, cloud platforms, and CX leadership.

-

Well-being and Retention: Career ladders, coaching, and performance gamification cut attrition and protect knowledge capital.

-

Sustainability: Renewable-powered sites, paperless operations, and e-waste programs increasingly feature in RFP scoring.

Strategic Recommendations for Buyers

-

Design a Portfolio Strategy: Blend in-country for compliance-critical work with diversified nearshore/offshore capacity to balance cost, resilience, and language needs.

-

Anchor on Platforms: Standardize on a small set of cloud contact center, workflow, and data platforms to simplify integrations and speed change.

-

Contract for Outcomes: Tie payments to business metrics and insist on a transformation backlog with quarterly value realization.

-

Govern AI Responsibly: Establish model governance, bias testing, and human oversight; document explainability and audit trails.

-

Invest in Knowledge Transfer: Codify SOPs, build shared knowledge bases, and co-locate transition teams for a strong first 90 days.

Strategic Recommendations for Providers

-

Differentiate with Domain Depth: Build specialist pods for BFSI compliance, healthcare revenue cycle, and e-commerce fraud where barriers to entry are high.

-

Scale Multilingual Hubs: Develop language academies (Japanese, Korean, Mandarin, Thai) and premium-pay tracks to secure scarce skills.

-

Productize BPaaS: Offer preconfigured processes with embedded analytics and connectors for common ERPs/CRMs to shorten sales cycles.

-

Measure and Market Value: Publish verified case metrics—service-level improvements, cost-to-serve reduction, revenue uplift—to move beyond rate-card debates.

-

Harden Security and Resilience: Multi-region active-active designs, rigorous DR drills, and continuous cyber monitoring are now table stakes.

Outlook

The APAC BPO market will continue to outpace global averages as enterprises pivot to digital, data-driven operations and seek partners who deliver outcomes, not just labor. Locations that combine scale, language breadth, regulatory maturity, and technology fluency will lead. Providers that orchestrate hybrid delivery, embed AI responsibly, and prove measurable value will capture the most attractive, multi-year contracts across the region.

Last Update: August 19, 2025