In India’s fast-paced business world, where startups boom and enterprises expand rapidly, payroll management is more than just a task—it’s a strategic necessity. With over 67% of Indian businesses adopting payroll automation by 2024 (projected to reach 85% soon), manual spreadsheets are becoming obsolete. Payroll software in India tackles the complexities of TDS, PF, ESI, and ever-changing labor regulations, making it essential for businesses of all sizes. Whether you’re a small MSME or a global corporation, the right payroll tool ensures timely payments, compliance, and satisfied employees. In this guide, we’ll explore why payroll software is a must, key features to look for, and highlight top solutions, including the innovative TankhaPay.

Why Payroll Software is Essential for Indian Businesses

Navigating India’s payroll landscape is no easy feat. From computing gross-to-net salaries with variable pays to filing quarterly TDS returns (24Q) and managing state-specific professional taxes, errors can lead to hefty fines or unhappy employees. Manual processes are not only time-consuming but also prone to mistakes.

Payroll software in India transforms this chaos by automating critical tasks:

-

Compliance Made Easy: Automatically manages EPF, ESI, TDS deductions, and stays updated with legal changes.

-

Time Savings: Processes bulk salaries quickly, integrates with attendance systems, and delivers payslips via SMS or portals.

-

Scalability: Adapts to your workforce size, from 10 to 10,000 employees, without skyrocketing costs.

-

Cost Efficiency: Saves up to 110 hours of HR time monthly, as reported by an Ecotech Services manager after adopting automation.

In essence, payroll software empowers HR teams to focus on talent management and business growth.

Key Features to Look for in Indian Payroll Software

Not every payroll tool fits India’s unique needs, like varying PT slabs across states (e.g., Maharashtra vs. Karnataka). Here’s what to prioritize:

|

Feature |

Importance for India |

Benefit Example |

|---|---|---|

|

Statutory Compliance |

Automates TDS, PF/ESI, PT, and gratuity rules |

Prevents penalties from late filings |

|

Flexible Pay Structures |

Handles HRA, allowances, and incentives |

Supports diverse employee needs |

|

Integration Capabilities |

Connects with banks, HRMS, and accounting tools |

Enables smooth NEFT salary transfers |

|

Self-Service Portals |

Apps for payslips, leave requests, and claims |

Enhances transparency, reduces HR queries |

|

Analytics & Reports |

Custom dashboards for audits and forecasting |

Drives informed financial planning |

|

Secure & Mobile |

Cloud-based with encryption and role-based access |

Supports remote and hybrid teams |

Choose software with user-friendly interfaces and free trials. Scalable pricing (often free for <10 employees) is a plus.

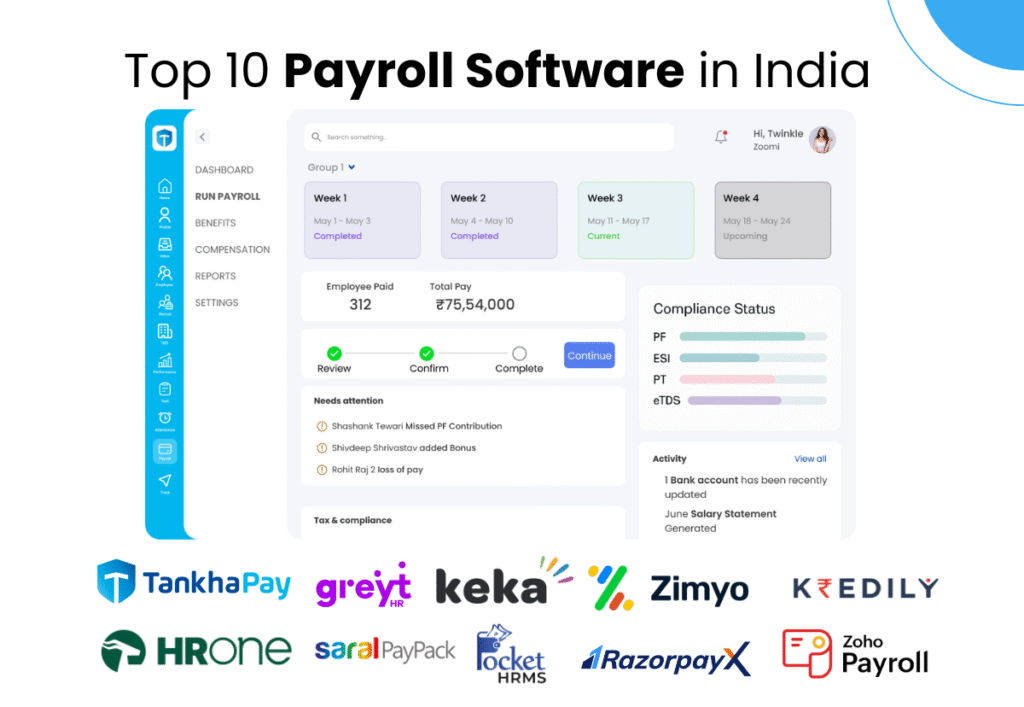

Top Payroll Software Picks for India

The Indian market offers a range of payroll solutions, from free tools to enterprise-grade platforms. Based on compliance, features, and user feedback, here are some top players:

-

Zoho Payroll: Perfect for Zoho users. Automates payments, leave tracking, and regional compliances. Pricing: Free for small teams, affordable scaling.

-

RazorpayX Payroll: A compliance champion, auto-filing TDS, PF, ESI, and PT. With 45+ integrations, it’s ideal for startups and freelancers.

-

SumoPayroll: Free for <10 employees. Cloud-based with simple portals for attendance and deductions—great for startups moving from Excel.

-

Keka: Employee-focused with mobile payslips and remote access. User-friendly for businesses of all sizes.

-

greytHR: A 20-year veteran offering end-to-end HR-payroll solutions with robust analytics for midsize firms.

-

ADP India: Global expertise with local customization. A unified platform, named Global Payroll Supplier of 2022.

-

Zimyo: SME-focused with tools for attendance and claims. A rising star since 2018.

-

TankhaPay: A comprehensive workforce solution (more below). Combines payroll with EOR and apprentice compliance for dynamic businesses.

Each excels in specific areas—Razorpay for automation, greytHR for depth. Test a few to find your fit.

Why TankhaPay Stands Out

TankhaPay isn’t just payroll software—it’s a complete workforce management platform tailored for India’s dynamic needs. As the #1 workforce app, it streamlines payroll, compliance, and HR tasks with ease.

What makes TankhaPay unique?

-

Effortless Automation: Track attendance via an employee app, auto-generate payslips, and process salaries in flexible modes (self-managed, hybrid, or automated).

-

Compliance Simplified: Handles EPF, ESI, TDS, and labor law updates, plus NATS apprentice tools and KYC verification.

-

Employee-Centric: Offers a helpdesk for PF/ESI queries and self-service portals for onboarding and claims, boosting transparency.

-

Scalable & Versatile: Supports startups to enterprises with EOR services and managed payroll outsourcing, ensuring accuracy and speed.

Users love its intuitive design: “TankhaPay made our payroll process seamless,” says an MSME owner. If you’re juggling multiple tools, TankhaPay’s all-in-one solution could be a game-changer. Try their free demo to experience it firsthand.

Final Thoughts: Pick the Right Payroll Solution

In 2025, sticking to manual payroll in India is like driving without navigation—doable, but inefficient. With tools like TankhaPay offering integrated, compliant solutions, switching is a no-brainer. Focus on automation, India-specific features, and scalability to future-proof your business. Ready to say goodbye to spreadsheets? Test a tool today and transform your HR operations.